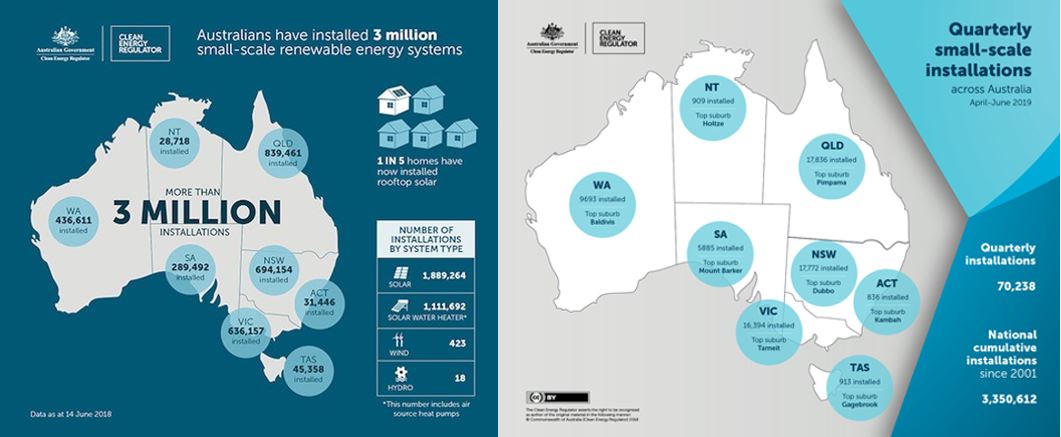

The SRES provides incentives to households and small businesses by issuing small-scale technology certificates for every megawatt hour of renewable energy generated or displaced by an accredited solar panel, wind, hydro system, solar water heater or air source heat pump.

The majority of small-scale installations are rooftop solar panel systems, providing around 63%of the three million total, with solar water heaters (29%) and air source heat pumps (8%) making up the majority of the remaining systems.[3]

Thanks largely to the scheme, by mid-2018 one in five Australian homes was generating its own renewable energy and reducing carbon emissions through rooftop solar.

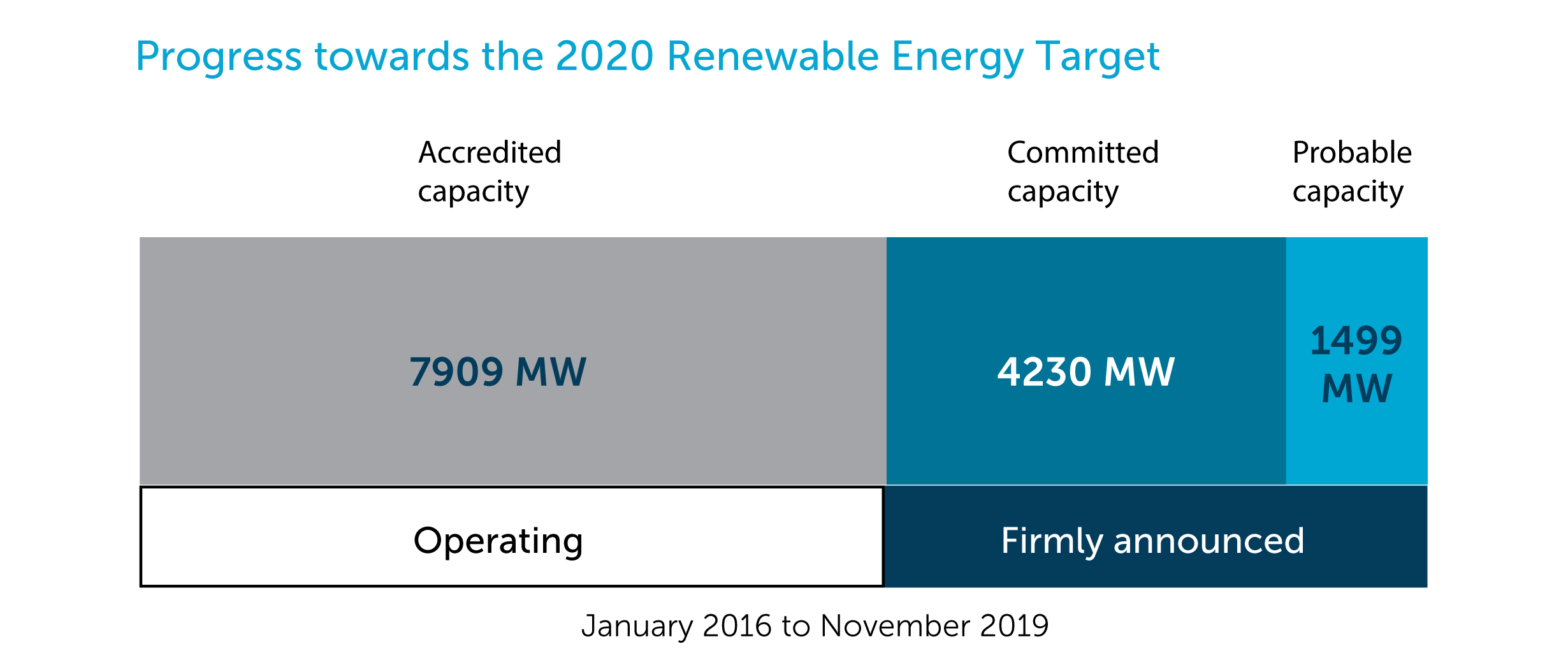

The success of the SRES is matched by large-scale installations. In 2018, a report from the Clean Energy Regulator said that Australia was ahead of schedule in meeting the large-scale target of 33,000 GW hours of renewables generation by 2020. And the country did indeed reach this target one year early, in 2019.

Since then, however, a series of devastating bushfires have shone the spotlight firmly on the impact of climate change, while perceived government complacency towards the UN’s Paris Agreement targets has called into question its longer-term renewable energy strategy.

In an interview that Abdul Latif Jameel coordinated with Carlo Frigerio, FRV’s managing director for Australia, he talked about the current state of the country’s energy market, FRV’s track record of successful investments and potential opportunities for the future.

Could you provide a quick overview of the Australian energy market?

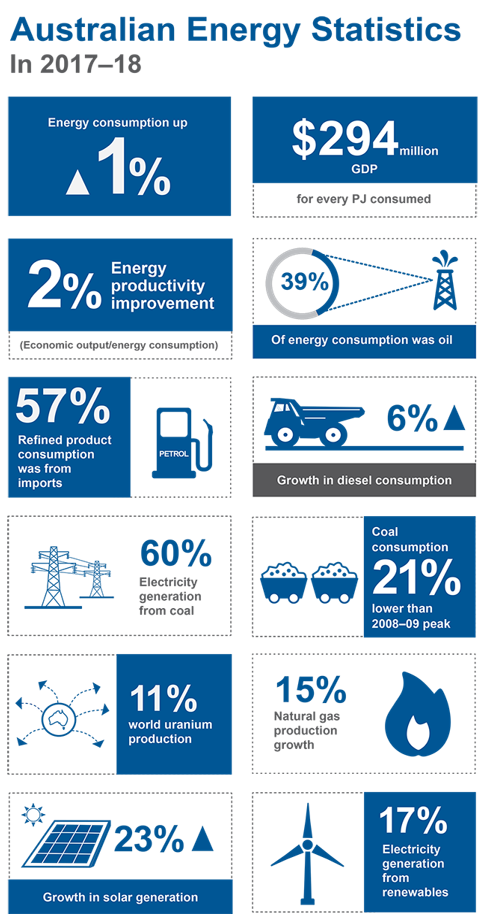

Australia is one of the largest developed economies in the Asia Pacific region, with an estimated GDP growth of 2.3% per year. Its economic growth is reflected in its energy needs and consumption, as well as the forecast for energy demand across different states. Demand growth is expected to remain robust in the future on the back of a well-performing economy. Medium-term forecasts (2018-2023) estimate an annual energy growth rate of 2.1%.

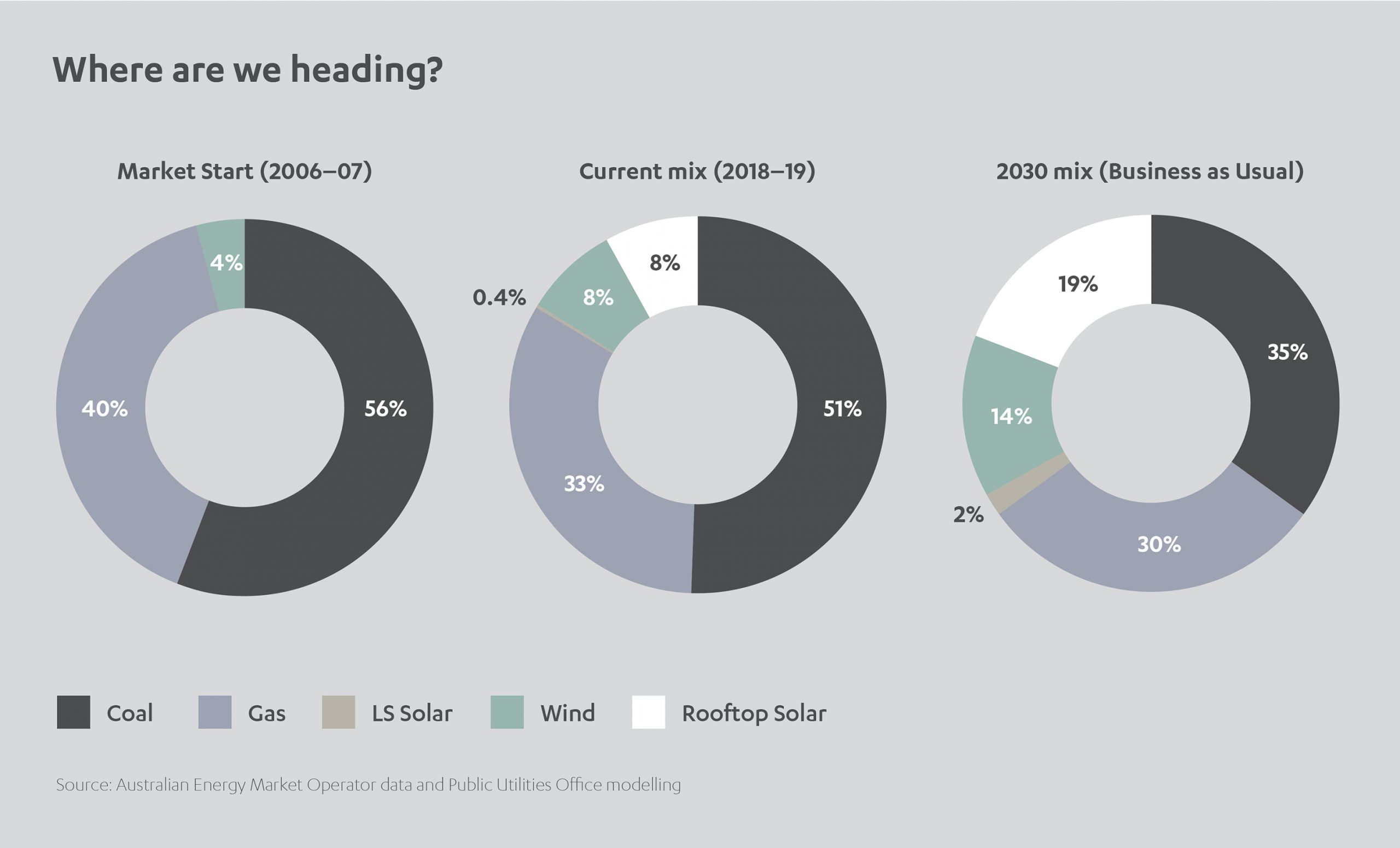

Currently, Australia gets around 21% of its annual electricity generation from renewable sources, mainly solar, wind and hydro, with a little bioenergy.

The solar market really kicked off in around 2013, which is when FRV started construction of the first Australian large-scale solar farm, at Royalla.

We were one of the first international solar developers to enter the market and see its potential. Since then, lots of others have followed, supporting the development and expansion of solar to around 2.5 GW of large-scale solar generation.

What is the potential for renewables in Australia?

It’s very positive. Australia is currently the second-largest coal producer and exporter in the world after Indonesia and is still highly reliant on fossil fuels. But the government is committed to a comprehensive closure program for its coal-fired generation plants. This means that 6.5 GW of coal capacity is expected to shut down before 2030 and 16 GW of coal capacity expected to leave the National Electricity Market (NEM) by 2050 and will need to be replaced in some form.

This energy transition has started already and will dramatically change the energy mix in Australia for the coming years. It will open up a huge opportunity for solar and renewables to fill the gap.

For that to happen, however, the NEM needs upgrading to facilitate the energy transition as the current infrastructure isn’t suitable in some parts of the grid. This is likely to take some time. So, this slowed down the investment in renewables rates in 2019 which will increase again once the upgrade is complete.

The physical impact on our projects has been limited, as we always choose our locations very carefully, but in some cases, it has impacted timings.

Looking ahead, once the transmission line upgrades are complete, the fundamentals for Australia are all there. Our consolidated position in the country allows us to navigate through the turbulence of the next couple of years to then be even more successful in the future. Australia is a growing economy, it has a strong currency, stable political environment, so it’s a very safe country from a credit risk perspective.

Solar PV continues to be, by far, the most popular source of renewable energy generation globally. Is that the same in Australia? Do you expect it to change?

Both solar and wind have had a rapid expansion in Australia representing 5% and 7% of the total installed capacity in the country respectively.

The great advantage of solar when compared to wind is its lower visual impact; wind developments are generally less popular compared to solar PV because they have a bigger impact on the landscape. This does not mean that wind farm developments that respect the landscape and have adequate visual impacts assessments are refused planning permission, it just means that developing a wind farm generally takes longer than a solar PV plant.

It has been reported that the era of cheap coal in Australia is over, and solar and wind power are now cheaper. To what extent is this accurate?

This is correct. Several studies have shown that, across the globe, solar PV can deliver a reduced LCOE[4] compared to other technologies, and this includes Australia. The planned coal closures will provide an opportunity for the most competitive technologies to fill the gap.

The main driver is the decreasing cost of technology. However, during the past couple of years, we have seen marked improvements in efficiency that also reduce the relative cost of renewables and therefore increase their competitiveness. In the case of solar PV, one example is the introduction of bi-facial modules – solar panels that can capture the sun on both surfaces. FRV used bi-facial modules for the 296 MW Potrero in Mexico, as well in our Winton solar farm in Victoria.

https://www.youtube.com/watch?v=cWePjsYRHVg

PV module costs have already dropped more than 80% over the last five years. In general, all-in solar installation costs have fallen significantly in recent years and are projected to continue declining, albeit at a less dramatic rate. If you look at wind, it is a similar story. Turbine costs are down 32% since 2010, while machine efficiency is up.

FRV has a partnership in the UK with Harmony Energy, an energy storage specialist. It is also developing a project in Chile that includes battery storage. Where is Australia in terms of battery storage?

Storage makes a lot of sense for Australia, especially for solar. For example, a manufacturing company might have their peak of production early in the morning and late in the evenings. So that’s when they need most power. But that doesn’t match well with solar, where the peak hours are in the middle of the day. Battery storage would therefore give us more options to expand generation outside the peak sun hours.

At the same time, storage can also play an important role as a stabilizer of the grid, especially in certain areas. In our own pipeline, we have a project in South Australia that is 100 MW solar and a co-located 50 MW battery.

Manuel Pavon, FRV Managing Director for South America, told us in a recent article that in Chile, there is an increasing expectation that RFP bids will include battery storage so they can provide power 24/7. I s Australia getting to that stage?

Australia is likely to follow the same path. I think so far there have been a handful of government-funded large storage projects, but no significant private investments. Largely because the technology costs are not quite there yet. But as soon as the technology costs come down, I don’t think it will be long until we see more activity in the market.

Given the recent bushfires in Australia, how supportive of renewable energy is government policy?

At the time of the last federal election (May 2019) more than 80% of Australians wanted the Government to take more action on climate change. Renewables in Australia are not only accepted but demanded strongly by the public.

There has been a wave of dissatisfaction with the government’s energy strategy over recent months, even before the bushfire crises. Quite often I would look outside my office window in Sydney city center on a Friday afternoon and see protesters demanding more climate action from the Government.

Australia’s energy strategy – called the RET – targeted 33 GW hours of renewable energy generation by 2020. This target was achieved in 2019, which was great. But a lot of people say the federal government took the attitude that they could relax and didn’t have to do anything more, so there was no new policy to build on the RET.

But that’s precisely what the industry needs in order to create a secure long-term investment climate. OK, the different states have their own policies, but it is very difficult if there is not a unified federal policy that links it all together at an overarching federal level, including commitments around important elements like transmission line upgrades, coal closures and infrastructure modernization. At this stage there is nothing like that.

The bushfires have really focused attention on this and hopefully there will be action. I saw a report the other day that said Australia’s greenhouse gas emissions in 2020 are estimated to be only around 1.6% below the 2000 levels. In contrast, Australia is committed to achieving a 5% reduction by 2020, so it is way off target. That’s also why we need a clear, ambitious federal policy on renewable energy.

With the lack of clarity at the federal government level and the on-going upgrades to the NEM, do you expect the next couple of years to be a little bit quieter, in terms of developments?

Yes. They’re definitely going to be a little bit drier compared to 2017/2018. But there will still be opportunities. When things get more complicated, it becomes an opportunity for developers that already have a consolidated presence in Australia, like FRV. It comes down to the quality of your portfolio. Our portfolio is strong, and we will keep developing and delivering high-quality projects.

FRV now has six projects in Australia and has invested more than US$ 700m since 2012. What are the next big opportunities you see for FRV?

Australia itself remains a land of opportunities for FRV. FRV has a leading position and strong credibility in the Australian market, which is forecast to have a robust renewables generation sector over the years to come.

Goonumbla (68.7 MW), our fifth project in Australia, in New South Wales, is currently under construction. We are also progressing with our sixth project in the country, Winton solar farm in Victoria, which is 85 MW, reaching financial close last February, and we have recently signed a PPA with Snowy Hydro to deliver solar power generated from the 90 MWac Sebastopol Solar Farm in the State of New South Wales, Australia.

Together with our track record and our strong pipeline, FRV will continue to play a key role in the Australian renewable energy space. Technology diversification with storage and potentially wind, would allow us to consolidate and strengthen our Australia portfolio still further. So, stay tuned…

Source: alj.com

[1] https://reneweconomy.com.au/australias-main-grid-reaches-50-per-cent-renewables-for-first-time-17935/

[2] Australians install a record three million small-scale renewable energy systems

[3] Australians install a record three million small-scale renewable energy systems

[4] LCOE = Levelized cost of Electricity, is a measurement used to assess and compare alternative methods of energy production. The LCOE of an energy-generating asset can be thought of as the average total cost of building and operating the asset, per unit of total electricity generated over an assumed lifetime).

Source: Australian Government, Clean Energy Regulator

Source: Australian Government, Clean Energy Regulator